CFDs vs Stocks: Which Trading Instrument is Right for You?

What Are CFDs and Stocks?

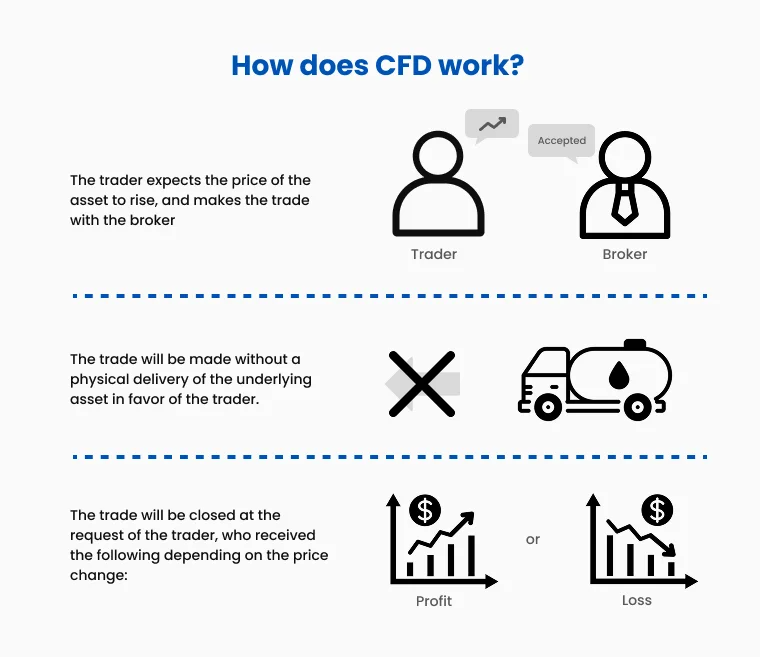

CFDs (Contracts for Difference)

Derivative products allow traders to speculate on the price movements of various assets without owning the underlying asset.

Used to trade on stocks, commodities, forex, and indices.

The difference in the opening and closing prices of the contract determines profits or losses.

Stocks

Represent partial ownership in a company, giving shareholders a stake in its assets and profits.

Traded on stock exchanges like the NYSE, NASDAQ, and LSE.

Investors benefit through capital appreciation and dividends over time.

Key Similarities Between CFDs and Stocks

Market Access: CFDs and stocks offer exposure to the equity markets, allowing traders and investors to speculate on company performance.

Price Movements: Both instruments are influenced by earnings reports, economic indicators, and global events.

Trading Platforms: CFDs and stocks can be traded online, which offers convenience and accessibility to participants worldwide.

Risk and Reward: Both carry risks, such as market volatility, but when approached strategically, they also present opportunities for gains.

Major Differences Between CFDs and Stocks

Ownership

CFDs: No ownership of the underlying asset; purely speculative.

Stocks: Direct ownership of the asset, providing voting rights and dividends.

Leverage

CFDs: Typically allow trading with leverage, magnifying both gains and losses.

Stocks: Usually traded without leverage, requiring full upfront payment of the share price.

Cost Structure

CFDs: May include spreads, overnight holding fees, and commissions.

Stocks: Costs typically include broker commissions and exchange fees, with no holding costs.

Time Horizon

CFDs: Suited for short-term trading due to leveraged positions and overnight fees.

Stocks: Better for longer-term investment strategies, benefiting from potential capital growth and dividends.

Regulation and Protections

CFDs: Operate under different regulatory frameworks depending on the broker and jurisdiction, often without shareholder protections.

Stocks: Regulated by stringent stock exchange laws, offering investor rights and protections.

Risks of CFDs vs Stocks

#1 CFD Risks

Leverage can amplify losses, potentially exceeding initial deposits.

Subject to overnight fees, eroding profits for longer-term trades.

Requires constant monitoring due to higher volatility.

#2 Stock Risks

Market volatility can impact stock prices, leading to capital losses.

Lower liquidity in smaller stocks can make trading challenging.

Long-term investments are exposed to macroeconomic and company-specific risks.

Which Instrument Suits You?

Choose CFDs if:

You prefer short-term speculative opportunities.

You want to trade on margin to maximize capital efficiency.

You’re looking to diversify across multiple markets like forex or commodities.

Choose Stocks if:

You aim for long-term wealth creation and value investing.

You prefer the security of owning assets with shareholder rights.

Dividends are a key factor in your investment strategy.

Final Thoughts: CFDs vs Stocks

The difference between CFDs and stocks lies in how they are traded and the level of flexibility they offer. Recognizing this difference can help you align your strategy with your financial goals.

While CFDs provide greater flexibility and access to a wide range of markets, stocks offer long-term stability and ownership advantages. Regardless of which you choose, a well-researched approach is essential.

Trade Smarter Today

FAQs About CFDs vs Stocks

What is the difference between CFD and stock?

Which suits short term vs long term?

What costs will I pay on CFDs vs stocks?

What are the main risks with CFDs and stocks?

How does leverage change the trade compared with buying shares outright?

Account

Account

Instantly